The Medical Indemnity Fund and the Price of Good Intentions

Introduction

The principal focus of this paper is the Medical Indemnity Fund (the “MIF”), which was created in 2011 as part of the Medicaid Redesign Team’s charge under the rubric of medical malpractice reform. The MIF established a State budget funding source for the future medical expenses associated with birth-related neurological injuries, which relieved hospitals and other providers from funding these costs either through traditional medical malpractice policies or through various self-insurance arrangements.

But before I delve into the issues surrounding the MIF, I’m hoping you will indulge me with a midsummer rumination on the issue of openness in government. Although this seems like a digression, the theme is also important to our recommendation about what the State should do next regarding the MIF.

As the country has become more polarized, and the press views every story through the prism of scandal and controversy, the reaction of government at all levels has been to do more business behind closed doors and to seek to tightly control every message. Admitting the trade-offs of policy decisions and the inevitable hits and misses of governing is viewed as a sign of weakness. Instead, the modern norm is a self-congratulatory tone that makes a cynical public even more cynical.

The collapse of President Biden’s candidacy when it became undeniable that the ‘Emperor wore no clothes’ is simply emblematic of this broader trend. Count me among the legions who were furious at the enablers who covered up a truth that, if known, would have prevented President Biden from taking a potentially cataclysmic risk with the country’s future. But for the campaign’s decision to hold an early debate – disastrous for Pres. Biden but fortuitous for the public – Democrats would be facing a near certainty of loss of the presidency and a high likelihood of losing both houses of Congress.

As I wrote in my Commentary on Transparency and Openness in State Government, the relentless spinning by officials at all levels of government “contributes to the sense that the government believes, to borrow a phrase from Jack Nicholson in A Few Good Men, that the public ‘can’t handle the truth.’” President Biden’s family, staff, and other enablers clearly believed that “the public couldn’t handle the truth.” Relentless spinning at some point becomes gaslighting the public. It increases cynicism and undermines confidence in government.

That leads me to why Sally, Adrienne, and I are taking the time to write these papers on esoteric issues involving health policy in New York. The simplest answer is that we think addressing important but technical issues, informed both by our experience in government and the luxury of time to think about such issues, will, at the margin, contribute to better policy choices and better understanding by the public of the stakes involved.

Writing about topics such as the MIF or the California MCO tax is not generally thought of as “kiss and tell” behavior. But having served in four New York State gubernatorial administrations, I’m not shocked that our analysis of even technical policy issues can sometimes ruffle feathers. But unless outside groups such as ours that have the capacity to analyze and write about these types of issues do so, the only people likely to be communicating with policymakers and the public on these topics will be the stakeholders who have a dog in the fight.

We make every effort to be accurate as it relates to underlying facts of the analysis, and we will correct ourselves when we become aware of mistakes and occasionally provide updates if new information on the topic emerges. To that end, we are posting an updated version of our Commentary on Fiscal Frameworks in New York State. Our original Commentary came out before the Enacted Budget Financial Plan was published and, therefore relied on financial estimates based on the FY 25 Executive Budget and the official Budget press release. Our estimates were fairly close in almost all cases, although the actual rate of FY 25 growth in State Operating Funds was 9.7%, more than double the estimated rate of growth of 4.5% included in the FY 25 Executive Budget and well above the average increase in State Operating Funds spending of 4.1% over the last 14 years.[1]

Now, let’s turn back to the MIF.

The State of Play of the MIF

On May 3, 2024, the Hochul administration announced that it was ending the acceptance of new individuals to the MIF, as required by a statutory provision that bars new entrants to the program if the next year’s payments are greater than 80% of the reserves of the MIF. In response to an outcry from families who would be affected by this decision, the Hochul administration reversed course three weeks later and deposited $58 million to reserves of the MIF (in addition to the $52 million appropriated in the FY 25 Budget) to enable the MIF to continue accepting new participants, at least for the time being.

The future of the MIF is one of dozens of policy choices made by State government that are the subject of intense focus among the small group of stakeholders most directly affected by the program, but generally ignored by the press and public. Individually, these policy choices are not important enough to attract the attention of the general public, but collectively, these choices represent a significant amount of the discretionary spending by the State.

Although the press generally has addressed the issue of the future of the MIF in a cursory way, uncharacteristically for issues of this type, Grace Ashford of the New York Times has written not one but two extensive stories about the MIF. The first story described the below-the-radar State action to “quietly suspend” new enrollments in the MIF,[2] while the second story detailed complaints from family members about the shortcomings of the program compared to receiving a lump sum medical malpractice payout.[3] The second article succinctly describes the issue at play:

“The state now must reckon with a dilemma: Should it continue to enroll children into an unpopular and expensive program? Or should it close the fund to new applicants, a move that hospitals say would increase malpractice insurance rates and could lead them to close more maternity wards in New York?”[4]

The purpose of this paper is to examine that dilemma by analyzing the financial ramifications of the decision whether to cease adding new participants to the MIF program or continue the status quo. Notwithstanding that some, but not all, families have complaints about the administration of the MIF, the State’s policy decision primarily rests on the financial implications of closing the MIF to new enrollment compared to maintaining the status quo.

The analysis of the financial ramifications of the decision about the future of the MIF is straightforward. We simply need to (i) estimate the cost to hospitals in the form of increased medical malpractice insurance expense if the MIF is closed to new participants, and (ii) estimate the peak annual cost to the State (and when that level of spending would be reached) if the MIF is continued in its current form and remains open to new participants.

The State contribution to the MIF is supported by a 1.6% tax on inpatient obstetrical services, excluding neonatal care, that is structured similarly to other provider taxes. The State has chosen to charge its contribution to the MIF against the Public Health (non-Medicaid portion) of the Health Department’s budget. To put the amount of State contributions to fund the MIF in context, total discretionary State spending on traditional public health programs in the State budget is approximately $1 billion, so the opportunity cost of this program is high.

An Abbreviated History of the Medical Indemnity Fund

The impetus to create the MIF grew out of the 2011 Medicaid Redesign Team’s (MRT’s) efforts to develop comprehensive recommendations to control healthcare costs and improve quality. Medical malpractice costs in New York are among the highest in the nation. The MRT established a medical malpractice workgroup with stakeholders on both sides of the malpractice issue. However, the influence of the medical malpractice bar on the legislature is so strong that they were able to block the medical malpractice workgroup from advancing any recommendations. Instead, the MIF emerged from direct negotiations between the Governor’s Office and the trial lawyers’ bar. The MIF initiative was added to the MRT final report as a medical malpractice reform.

The MIF covers qualifying healthcare costs for children with birth-related neurological injuries, such as cerebral palsy. Two other states – Virginia and Florida – have a birth-related neurological injury fund. The funds in both states are structured as “no-fault” insurance. Eligibility requirements are tighter, which makes these programs somewhat less expensive than New York’s. The expenses covered by the MIF typically include costs for medical treatment, rehabilitation services, medication, home care services, environmental modifications, and any other health-related needs that are directly connected to the neurological injury sustained at birth. Other neurodevelopmental conditions, such as autism, that are not the result of a birth-related injury are not covered by the MIF.

The MIF’s stated intention was to reduce medical malpractice insurance costs for hospitals while reducing the number of birth-related neurological injuries through various quality initiatives, including one to be developed by New York State. The 2013 MRT Final Report estimated that the MIF would “lower premiums by $320 million annually.”[5] This estimate proved to be high by a factor of two in 2013 (although it is roughly the amount of premium reduction that exists today), but the estimate indicates the State’s recognition that the initiative would benefit hospitals significantly.

The MRT Final Report also noted that it had “created the Hospital Quality Initiative, with a specific obstetrical work group which will look to improve the effectiveness of maternity care that could translate into reduced medical malpractice and insurance premiums.” Although individual hospitals and hospital associations pursued various quality initiatives, the State Hospital Quality Initiative never got off the ground. To the extent this was part of the original intention of the MRT in adopting the MIF as an MRT initiative, it has not proved successful.

The State Senate FY 12 Budget report that described the MIF said that, “monies for the MIF ultimately result from a Hospital Quality Contributions of 1.6% of revenue from inpatient obstetrical services.”[6] This tax now generates approximately $65 million a year, which is more than the State’s long-standing contribution of approximately $52 million but well below the $110 million contribution in 2024 and even further below the State contribution that will be required if the MIF remains open to new participants. As often happens with “dedicated” funding sources, within a few years people forget the original purpose of the revenue source and the funding becomes fungible with all other State resources available to fund programs.

Revenue from the 1.6% tax on inpatient obstetrical services has long ceased to be a reference point for the level of State contributions to the MIF. Hospitals will certainly remind the State that their tax payments have been the funding source for nearly all of the State’s contributions to the MIF to date. However, revenue from this 1.6% tax will be needed for the next 20-30 years simply to finance the existing obligations of the State under the MIF.

One reason that quality initiatives have not reduced the number of birth-related neurological injuries is that the medical literature is clear that while malpractice can be a factor in birth-related neurological injuries, a significant portion of these injuries are attributed to the general risks of childbirth (not all of which are preventable), premature delivery, the use of clinical interventions during difficult deliveries, and pre-existing conditions or complications that are not directly related to the actions of healthcare providers.[7] Economics aside, it was thought that the existence of the MIF would at least partially change the paradigm from assigning fault and blame to the hospitals and physicians in these tragic situations to establishing a mechanism for ensuring that these individuals receive good care throughout their lives.

It was also believed that the MIF would also reduce the underlying costs both by reducing litigation time and expense. This goal similarly has proven elusive. Because eligibility for participation in the MIF requires a judgment or settlement acknowledging medical malpractice, the MIF has not significantly changed the process for resolving medical malpractice claims. The family is still entitled to sue to recover for other types of damages, such as pain and suffering. The MIF comes into play only when a case is resolved by a judgment of medical malpractice or a settlement of the case.

One reason the traditional malpractice litigation paradigm was preserved in the MIF was to justify trial lawyers receiving their contingency fee on the net present value of medical costs under the MIF. In addition to seeking participation in the MIF to cover all future medical benefits, plaintiffs may also sue for damages for pain and suffering. Knowledgeable observers state that the MIF has not reduced the length or complexity of medical malpractice cases, which can often take eight years or more before a settlement is reached or, in exceptional cases, a verdict is reached at trial.

Finally, the 2013 MRT “Multiyear Action Plan” also suggested that the State was exploring making State contributions to the MIF eligible for federal financial participation under Medicaid. Before the existence of the MIF, families would typically put settlement proceeds into a special needs trust so that the child would remain eligible for Medicaid. According to Pinnacle, as of year-end 2023, about 61% of all Fund participants would be reliant on Medicaid in the absence of the MIF.[8] However, the federal government declined to extend federal financial participation to contributions on behalf of children accepted into the MIF, even when those children would have been eligible for Medicaid in the absence of the MIF as an alternative funding source.

So, of the original goals of the MIF – to reduce malpractice costs for providers by shifting the expense of birth-related neurological injuries to the State budget, reducing the underlying expense associated with malpractice claims by reducing litigation expense and improving birth outcomes through quality initiatives, and obtaining a federal Medicaid match for the payment of these expenses – arguably only the first objective has been achieved.

Developments Since 2011 that Increased the Cost of the MIF

It is not clear what the basis was for the original MRT estimate that hospitals would realize annual savings of $320 million due to the MIF. Once the State developed some experience with the MIF, the actuarial studies projected a much lower long-term liability. For example, in 2018, the annual increase in the net present value of future medical benefits from that year’s cases – which is a good proxy for the maximum amount of annual savings to providers attributable to the MIF – was only $60.3 million, compared to the original estimate of $320 million.

A handful of changes in the MIF statute significantly increased the program’s cost. The most impactful of these changes by far was an amendment to the MIF statute that increased the reimbursement rates paid by the MIF from Medicaid rates to 80% of commercial “Usual and Customary Charges” for the service. This amendment was adopted in 2016 following an aggressive lobbying campaign by families of children in the MIF, who argued that higher reimbursement rates were necessary to improve access to care. The amendment was also strongly supported by the medical malpractice bar, whose contingency fees rose along with the increased cost of providing future benefits.

“Charges” for services are usually higher than the “allowed amounts” for such services that have been negotiated between hospitals and insurance plans. So, using commercial rates (as opposed to Medicaid rates) and then basing those rates on “charges” rather than “allowed amounts” resulted in much higher payments to providers. The MIF program actuaries, Pinnacle Actuarial Resources, Inc. (Pinnacle), concluded that an “overall increase in average payments of 122.9% [was] due primarily to the increased reimbursement rates” under the amended statute.[9]

In addition to higher reimbursement rates than were initially contemplated by the MIF statute, the biggest financial risk of the MIF has long been the fear that courts would interpret the MIF to cover conditions that do not meet the strict statutory requirements for eligibility. By design, New York’s MIF eligibility requirement is more inclusive than Virginia’s MIF. In Virginia, participants must be “permanently motorically disabled and developmentally disabled or cognitively disabled (emphasis added)” as well as “need assistance with all daily living activities.” The New York Fund requires either a physical or mental disability (emphasis added); both types are not required. This may explain in part why New York has more than four times the number of participants per 10,000 live births experienced by the birth injury funds in Florida and Virginia.[10]

The average number of participants admitted into the Fund declined over the last four years to an average of 79 new participants per year, compared to an annual average of 89 new participants in the earlier years of the MIF program.[11] Notwithstanding the statutory language that limits the MIF to birth-related injuries, it appears that, at least in some cases, courts have admitted “participants with less severe diagnoses such as ADHD and autism.”[12] In response to concerns from advocates that the State might administratively seek to exclude participants admitted by a court, the Enacted Budget in 2019 included procedural amendments for the Fund that removed the Fund administrator’s role in determining if a plaintiff is a “qualified plaintiff” and therefore eligible for the Fund.[13]

Estimating the Financial Implications of Closing Off the MIF to New Participants Versus Maintaining The Status Quo

In recognition of the risk that a pay-as-you-go approach could leave the State unable to pay for medical benefits to existing participants in the MIF, the MIF statute includes a circuit breaker that stipulates that the State must close new enrollment to the MIF when the next year’s payments would be 80% or more of the existing reserves of the MIF. The April 2024 Pinnacle actuarial report for the period ending December 31, 2023, stated that the threshold had been crossed at year-end, so the Administration was statutorily required to close the MIF to new entrants until it topped up the fund with an additional $58 million in reserves.

The circuit breaker does not mean that the existing MIF liability is fully funded so long as it keeps MIF reserves at 80% of the next year’s expected payouts in benefits. On the contrary, the net present value of the MIF just for existing participants as of December 31, 2023, is approximately $3.5 billion. Simply paying for existing participants will require annual contributions to the MIF of about $100 million a year through at least 2032-33, the last year estimated by the MIF actuaries.[14]

If the MIF is closed to new participants, the MIF will still be responsible for paying medical benefits to existing participants in the MIF and the State will be responsible for continuing to make contributions to the MIF that satisfy that obligation. However, future medical benefits for individuals not enrolled in the MIF at that time will need to be funded by providers.

The quarterly actuarial reports by Pinnacle provide a much more granular level of transparency about the MIF than is the case for most other major Health programs. The Pinnacle reports also include a good summary of issues involved in the MIF, which makes it relatively easy for outsiders to analyze and understand the program.

The Pinnacle report estimates the net present value of future liabilities under the MIF based on a relatively small number of assumptions, including the expected annual benefit costs based on the severity of the participant’s neurological injury and historical benefit patterns, participant life expectancy and mortality rates, the rate of medical inflation in the state of New York, appropriate rates for discounting benefit payments, expected annual investment income from funded liabilities, and projected administrative expenses over a participant’s lifetime. The Pinnacle report does not forecast the number of annual entrants to the MIF if the fund remains open to new participants, but we can estimate that number based on recent experience.

The Pinnacle report, dated April 2, 2024, stated that the net present value of the 992 current participants in the MIF as of December 31, 2023, is approximately $3.458 billion, based on the assumptions of aggregate annual benefit costs in the coming year of approximately $100.3 million, medical inflation of 3% annually and a discount rate of 2% annually.

As noted above, the financial implications of (a) closing the MIF to new participants versus (b) maintaining the status quo involves two straightforward questions:

- Approximately how much will annual medical malpractice premiums and benefit payments by hospitals increase if the MIF is closed to new participants; and

- Approximately how much and when is the peak level of annual contributions the State will need to make to the MIF if the status quo of the MIF is preserved and continues to accept new participants?

Our financial analysis of these issues is reflected in an Excel workbook that can be found on the Resources page of the Step Two Policy Project website. The spreadsheet is set up in a way that allows users to run their own sensitivities on the projections by adjusting various assumptions.

How much will hospital costs increase if the MIF is close to new participants?

If the MIF is closed to new participants, providers will need to fund the net present value of the liability created in a particular year, whether they are doing so through a medical malpractice insurance policy that fully covers the liability or through a variety of self-insurance mechanisms. Self-insured entities don’t need to fund a potential liability in the year it is incurred, but upon settlement or judgment (typically about eight years later), the self-insured provider must pay a lump sum amount to the plaintiff. The overwhelming majority of these provider payments are made by hospitals rather than individual providers.

It is relatively easy to estimate the first-year costs of providers to cover birth-related neurological injuries if the MIF is closed to new participants because it’s likely that the most recent actuarial experience of the MIF will be used to price the coverage. We estimate that the first-year cost of replacing the MIF would be approximately $315 million.[15] In the longer run, the ongoing annual cost will depend on the type of changes in actuarial experience that we discuss in more detail below under the scenario in which the status quo of the MIF is continued.

A good reality test for this assumption is the annual increase in the net present value of the liability for future medical benefits and administrative expenses. The annualized increase of that liability in the fourth quarter of 2023, as determined by Pinnacle, was approximately $343 million, although this proxy amount needs to be reduced by approximately 8% to reflect the benefit of investment income during the period between the incurrence of the liability and the payment of the settlement or judgment.

How much will the peak State contribution to the MIF be if the MIF remains open to new participants?

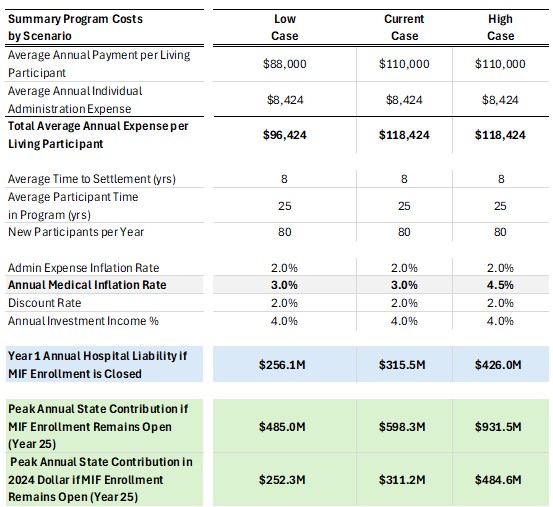

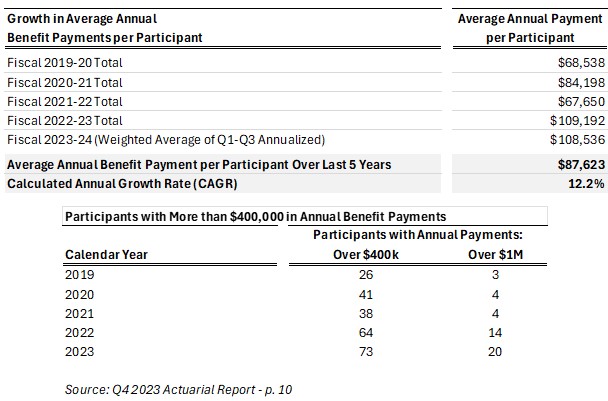

Estimating the peak State contribution to the MIF if the status quo is preserved is a more difficult exercise because of the inherent uncertainty surrounding actuarial assumptions. The actuarial assumptions that generate the widest variation in estimates are the number of new participants and the assumed average annual benefit payments. As shown in the first table below, the estimated average annual payment of medical benefits per cohort has increased dramatically over the last four years. Although this partly reflects the inflation in medical costs, the more significant factor is an increase in the number of severe cases admitted to the MIF, i.e., an increase in the number of high-need/high-cost participants. The second table below is pulled directly from the most recent actuarial report published by Pinnacle, and it highlights the steep increase in participants who receive annual benefit payments of over $400,000 and over $1 million in recent years.

It is difficult to know whether the patient mix that produced the annual level of benefits of the last two years is a new baseline or whether future cohorts will regress to the mean. For that reason, we estimate a range of the net present value of the liability created each year based on three different assumptions regarding the average annual payment of medical benefits. The low end of the range assumes that annual benefit payments will regress to the mean of the last five years (i.e., $87,623) and then grow at the rate of medical inflation, which is assumed to be 3%. The middle range assumes that annual benefit payments will increase at a rate of 3% from 2023 levels (i.e., $110,000). The high end of the range assumes that 2023 levels of benefit payments (i.e., $110,000) will continue to grow at 4.5% annually, which is approximately one-third of the CAGR of the last five years.

The number of new participants in the MIF on an annual basis is another assumption that is difficult to forecast over extended periods of time. The number of births in New York has declined since the Covid-19 pandemic, and demographers suggest this is a long-term trend that may continue. On the other hand, the trend of the last two quarters suggests that the number of new participants may be closer to the historical level of nearly 90 participants as opposed to the more recent trend of 80 participants. In order to not overestimate the potential liability of the State in our model, we assume that the current number of approximately 80 new participants per year will continue for the next 25 years.

Based on the same assumptions shown in the table above, we estimate that if the status quo of the MIF is preserved and remains open to new participants, the State contribution to fund the MIF will reach a range of $485 million to $931 million in 25 years based on different assumptions about the average annual per capita benefit costs, as reflected in the medical cost inflation rate.

The expression of that peak amount in 2024 dollars is very sensitive to the discount rate used for the estimate. Assuming a discount rate of 2%, the peak contribution across these scenarios would range from $252 million to $484 million in 2024 dollars, or about 2.5 to 4.5 times the current level of funding for the MIF.

What should the State do now?

The MIF is almost a textbook case of a public policy problem with competing interests and trade-offs. Unlike many of the policy challenges in the State’s health portfolio, it is well suited to an empirical analysis that can effectively inform better public policy decisions. The information necessary to perform this analysis is relatively accessible to outsiders because the Pinnacle report provides transparent and well-organized data about the program.

There are numerous ideas for reforming the MIF that would reduce costs and, perhaps, increase the participants’ level of satisfaction.

There are a number of incremental reforms that could improve aspects of the MIF. One structural idea that I believe merits further investigation is to limit participation in the MIF only to cases with a high value of expected future medical benefits. There is not sufficient information in the Pinnacle reports to define the threshold that would include in the MIF a minority of total cases but a majority of the annual liability. Pinnacle does stress, however, that it is the growth in high-cost cases (e.g., those with more than $400,000 in annual payments) that is driving the growth in average per capita medical expenses.

The advantage of making the MIF program available only as, in effect, an excess layer of insurance, is that it would reduce administrative friction by significantly reducing the number of cases the MIF had to manage while still socializing through the Budget a majority of the cost of this liability.

Among other potential reforms that would reduce the cost of the MIF include:

- revising the 2016 rate reimbursement level adjustment from the current 80% of usual and customary charges. Basing reimbursement rates on some alternative level, such as 100% of allowed amounts for all or most services;

- tightening the definitions of eligibility, which would help prevent the “scope creep” of the MIF into covering neurodevelopmental issues;

- creating a true “no-fault” insurance program for conditions that are tragic but statistically inevitable in the process of labor and delivery;

- allowing hospitals to purchase excess medical malpractice insurance from a fund similar to the MIF;

- implementing tort reforms that could reduce the time and expense of medical malpractice litigation generally; and

- renewing efforts to seek federal financial participation (i.e., a Medicaid match) for contributions to the MIF proportionate to the quantity of Medicaid births. There may be a way to restructure (or increase) the existing 1.6% Hospital Quality Contributions tax to enhance the amount of federal funding available to support State contributions to the MIF.

Potential reforms that could improve participant satisfaction include:

- streamlining the approval process for certain services and home modifications; and

- allowing the family to receive the net present value of future medical benefits, with the funds to be placed in a trust subject to certain restrictions but generally under the family’s control.

Consistent with my general belief about the benefits of openness in governmental decision-making, I would suggest that the State structure a formal process for addressing policy options to be completed in time for the Executive Budget to develop a recommendation on the MIF. The cost of the program is not the only issue. In 2017, a State Senate Round Table on the operation of the MIF enabled families to express their frustrations with the administration of the MIF and led to administrative reforms as well as changes in the reimbursement rate schedule.[16]

A structured process would enable hospitals to present their estimates of expected increases in malpractice insurance premiums and benefit payouts if the MIF is closed to new entrants. Insurance plans offering medical malpractice insurance could explain their estimates of the likely cost of replacing the MIF and whether there were features of the MIF that might increase actuarial cost more than they provide value to participants. Families would be able to present their frustrations with the way the MIF is administered that could improve the efficiency of, and satisfaction with, the program.

Conducting a structured process – particularly one that is transparent to the public – is not as easy as it sounds. It would be one more thing to do in a Health portfolio that faces massive implementation challenges, including the 1115 Waiver, CDPAP changes, and managed long-term care reforms, as well as the development of solutions for the growing number of financially distressed hospitals. It is easy to see why the State would prefer the alternative to a structured process, which is that the various stakeholders will present their case privately to the State, and then the State will do its best to strike a compromise that can satisfy the legislature and keep the issue under control.

Nevertheless, I think there are at least two compelling reasons to address this issue in a structured and open way. First, although the MIF doesn’t necessarily fall under the category of qualifying for the axiom that “a crisis is a terrible thing to waste,” the current crossroads may be the best opportunity the State will have to reform a program that has grown in some unintended ways since its inception – and still does not satisfy many participants.

The amount of annual State funding and the amount of long-term liabilities the State will be taking on if the MIF is structured in a way that enables it to remain open to new participants are quite significant. At the same time, the increased financial burden on providers in general, and hospitals in particular, if the MIF is closed to new participants, is also quite significant. Moreover, if the governor signs the Grieving Families Act (a.k.a., the “wrongful death” bill) passed by the legislature, the annual increase in malpractice costs from that law could be 2-3 times the impact of the MIF being closed to new participants. On the other hand, the State’s opportunity cost of maintaining the status quo of the MIF would eventually increase its contribution to fund the MIF by 2.5-5.0 times its current contribution in 2024 dollars.

A second reason for developing a long-term policy around the MIF in a structured and transparent way is simply that it would represent a step toward a less closed-door approach to governing. That may be inconvenient in the short run, but in the long run, I believe it will lead to better decision-making and public policy.

Paul Francis

August 8, 2024

Paul Francis is the Chairman of the Step Two Policy Project. He served as the director of the Budget in 2007 and as the Deputy Secretary for Health and Human Services from 2015 – 2020, among other government positions. The Step Two Policy Project is a policy think tank that focuses on issues involving health, behavioral health, and human services in New York. We work to accelerate the adoption of good ideas. This note and other writings by the Step Two Policy Project are published on Substack and on the Step Two Policy website.

[1] The magnitude of this increase in State Operating Funds spending might have attracted more attention if it had been included in the official Budget press release that comes out as soon as the Budget is passed, but this figure was left out and could not be calculated until the Enacted Budget Financial Plan report was released roughly a month after the budget was enacted.

[2] See, “A State Fund That Helps Children Hurt at Birth Is Quietly Suspended,” New York Times. May 24, 2024.

[3]“Fund to Aid Children Harmed at Birth Hasn’t Kept Promises, Families Say: The Medical Indemnity Fund was to provide worry-free health care to children severely injured at birth. But parents say it has failed them.” New York Times. July 20, 2024.

[4] Ibid.

[5] “A Plan to Transform the Empire State’s Medicaid Program: Better Care, Better Health, Lower Costs – Multi-Year Action Plan,” released by the Medicaid Redesign Team in 2013. Available: https://www.health.ny.gov/health_care/medicaid/redesign/docs/mrtfinalreport.pdf

[6] New York State Senate SFY 2011-12 Enacted Budget Summary at p. 11.

[7] Ojumah N, Ramdhan R C, Wilson C, et al. (December 12, 2017) Neurological Neonatal Birth Injuries: A Literature Review. Cureus 9(12): e1938. doi:10.7759/cureus.1938 – https://www.cureus.com/articles/10037-neurological-neonatal-birth-injuries-a-literature-review#!/

[8] Pinnacle Actuarial Resources, “New York State Medical Indemnity Fund 4th Quarter 2023 Actuarial Analysis as of December 31, 2023,” April 2024, at p. 23. Available: https://www.health.ny.gov/regulations/medical_indemnity_fund/reports/2023/docs/q4_acturial_analysis.pdf

[9] Ibid. at p. 17.

[10] Ibid. at p. 7.

[11] Ibid. at p. 11.

[12] Ibid. at p. 7.

[13] Ibid. at p. 7.

[14] Ibid. at p. 32.

[15] This assumes medical benefit payments for 25 years, which implies an average life expectancy of 33 years with eight years of litigation prior to admission to the MIF. It also assumes that investment income will be earned on the upfront amount of liability for eight years, at which point a lump sum payment would be made to the plaintiff.

[16] Senate Standing Committees on Health & Insurance – 6/14/2017.