Congress Went on Recess – But The Kids Keep Missing Out

Perhaps legislators and their staff do merit a break after a productive summer. But a permanent expansion of the Child Tax Credit is needed once they come back

August in the nation’s capital is not only infamous for sweltering heat and humid days (a marshy urban heat island now worsened by climate crisis). It’s also that time of year when corridors of power, influence and policy-making empty out. Literally. Members of Congress, in both House and Senate chambers, eagerly rush back to their home districts to reconnect with constituents, reboot and break – during an election year like this one, there’s quite a bit of fundraising and campaigning, as well. In D.C. parlance, we call this Congressional vacation the “August recess.” And just like the recesses from your school days, these weeks are begrudgingly viewed as a chance for Capitol Hill’s legislators and staffers to recharge so they can return refreshed in September.

No doubt, with the recent passage of an ambitious $430 billion Inflation Reduction Act, legislators and their staffers do merit a break. This new law kick starts the important investments we need: more affordable healthcare and direct climate crisis response, along with decreased deficits and much-needed revenue to the federal government through new tax provisions targeting large corporations and the wealthy. Especially exciting is the historic funding in our vital, but underfunded, Internal Revenue Service. A lack of resources to this critical agency (since the government can’t fund itself or function without it) has disproportionately impacted low-income taxpayers, many of whom are Black, Brown, Indigenous and Asian Pacific-Islander households of color. As we examine the legislation closer, we’re hoping the $80 billion of additional funding over ten years to improve tax enforcement leads to a fairer tax system that better supports our BIPOC communities.

Still, the Inflation Reduction Act is not enough. A glaring omission is a permanent expansion of the Child Tax Credit — a critical investment in children and their families. Remember: For six months in 2021, families received advanced monthly Child Tax Credit payments to keep their incomes steady. The elements temporarily added to the Child Tax Credit in the 2021 American Rescue Plan — refundability, advanced monthly payments, an increased credit amount – actually worked. Families used these funds for basic necessities like food, utilities, and car repairs. Did these payments or $250-300 per child replace work? Absolutely not, as numerous studies proved.

But what these payments did do is offer families the space, temporary peace-of-mind and desperately needed resources to easily put food on their tables, pay for childcare, get safe transportation to and from work, and pay for heat in their homes.

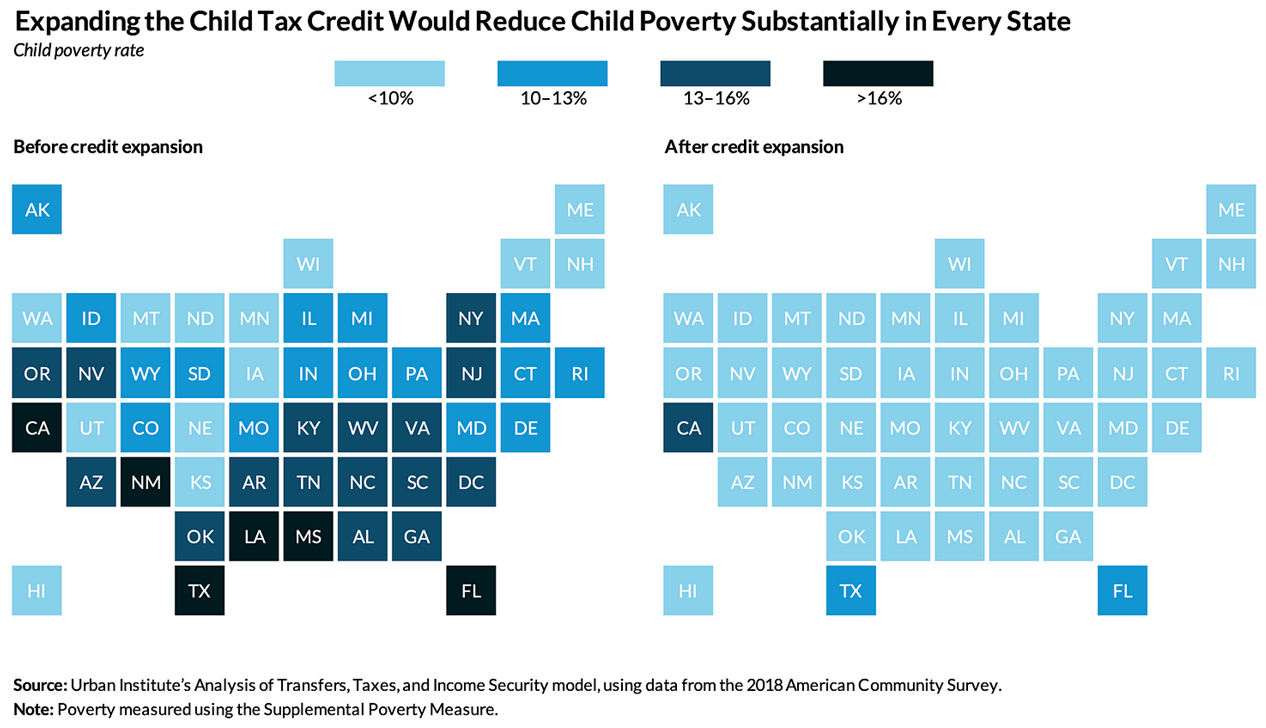

We miss the Child Tax Credit because our nation was in a much better place with it. Considering 70 percent of children in poverty being children of color, expanding the Child Tax Credit was a significant relief to already struggling BIPOC households wading dangerously through pandemic. Before the expansion, nearly half of all Black and Latinx children were excluded from the full benefit because their families did not owe enough federal income tax to qualify.

How do we know that the expanded Child Tax Credit worked? Because, by the end of 2021, 3.7 million children were kept out of poverty, including 163,000 Asian children, 737,000 Black children, and 1.4 million Latino children. Some of our nation’s best economic minds, in fact, have argued for its continued expansion.

But we cannot make expansions to the Child Tax Credit if it would mean cutting other crucial benefits programs and hurting families in the process. Recently introduced policies, like the Family Security Act 2.0 for example, contain draconian work requirements that would move us all in the wrong direction. With their racist origins, work requirements (as innocuous as they sound) are counterproductive. To build racial economic justice, we need provisions that support BIPOC communities, not hurt them.

Reducing inflation is important, but lower-income households also need immediate and regular support as they struggle to pay for goods and services due to rising costs and stagnant wages. BIPOC communities are especially impacted by rising costs and more severely crushed by inflation, particularly when with the insensitive price-gouging we’re seeing from skyrocketing rents and other essential survival items.

Was the expanded Child Tax Credit perfect? No — it excluded families based on which tax identification number they used to file their taxes. One million children from immigrant households could not access the CTC because they did not have a Social Security number. Mixed-status families contribute money to taxes and are often left out of relief, including pandemic relief. But this exclusion could easily be fixed in new legislation.

Three years into a pandemic, the economic and health situations of our families have gone from bad to worse. The time to build back for justice is now – we can’t wait any longer to reimagine and establish an economy that works for all of us. That’s why a first step on our path to racial economic justice is for our nation to invest in the Child Tax Credit. Let’s take this August summer recess, a pause in the busy lives of policymakers, to think more about how we should help kids and their families this fall. When Congress comes back to Washington in September, they should pass the Child Tax Credit expansion to finally give kids and their families the long overdue break they need … and deserve.

Written By: Gary Cunningham- Prosperity Now, President & CEO